Business Expenses Deduction 2025 - 1099 Tax Deductions List 2025 Lesly, Eligible businesses can claim an immediate deduction for the business portion of the cost of an asset in the year the asset is first used or installed ready for use. Uwrf Spring Break 2025. Fall 2025 spring 2025 summer 2025.…

1099 Tax Deductions List 2025 Lesly, Eligible businesses can claim an immediate deduction for the business portion of the cost of an asset in the year the asset is first used or installed ready for use.

/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)

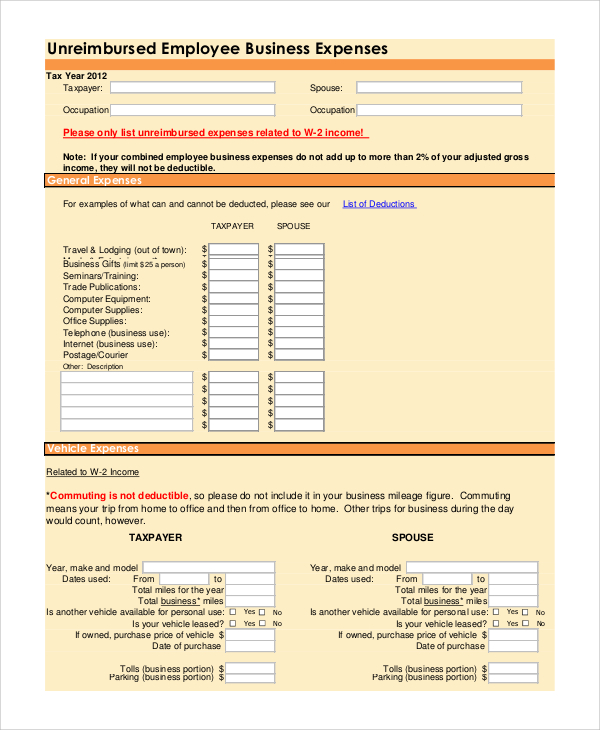

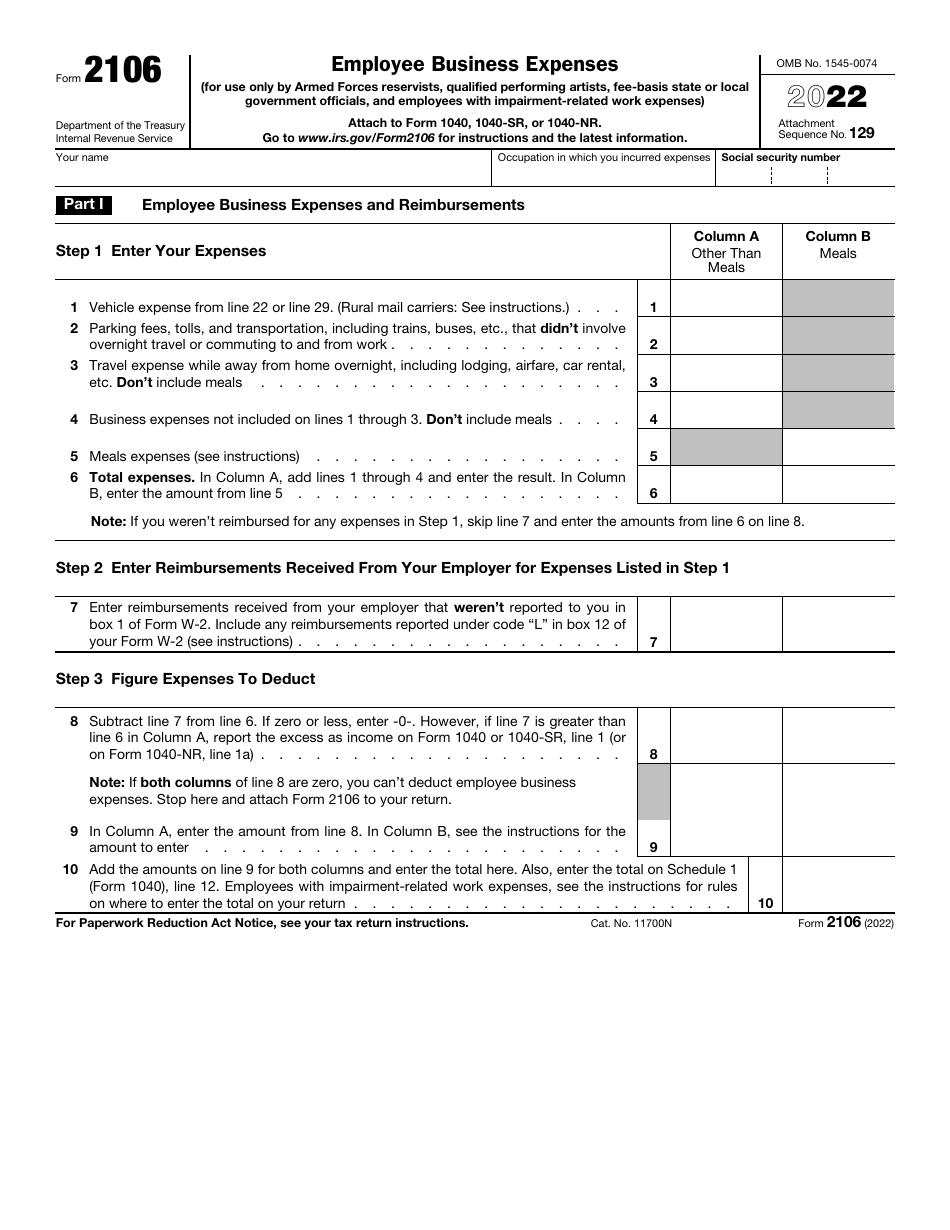

Employee Business Expenses Deduction 2025 Terza, Find out what expenses you can claim, when to claim, and the records you need to keep.

Festival Of Lights Parade Columbus Indiana 2025. An annual event…

Employee Business Expenses Deduction 2025 Terza, Here's how those break out by filing status:

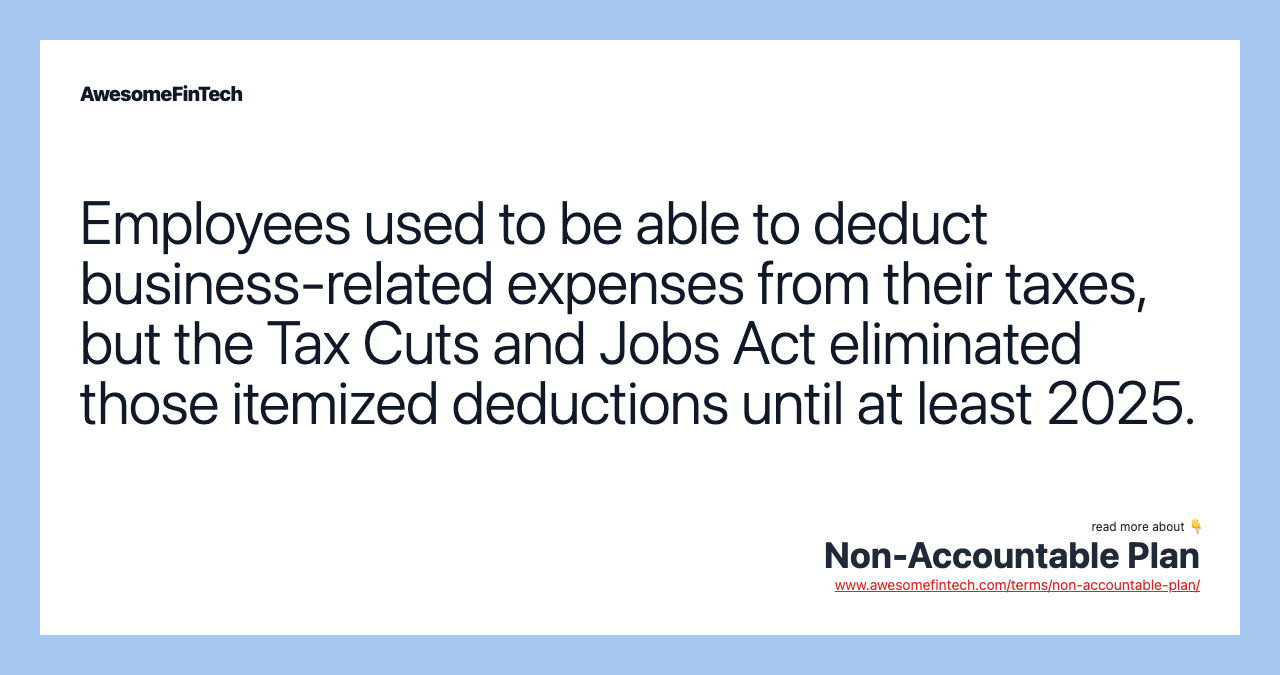

Employee Business Expenses Deduction 2025 Terza, What changes did the tax cuts and jobs act make to deductible business expenses?

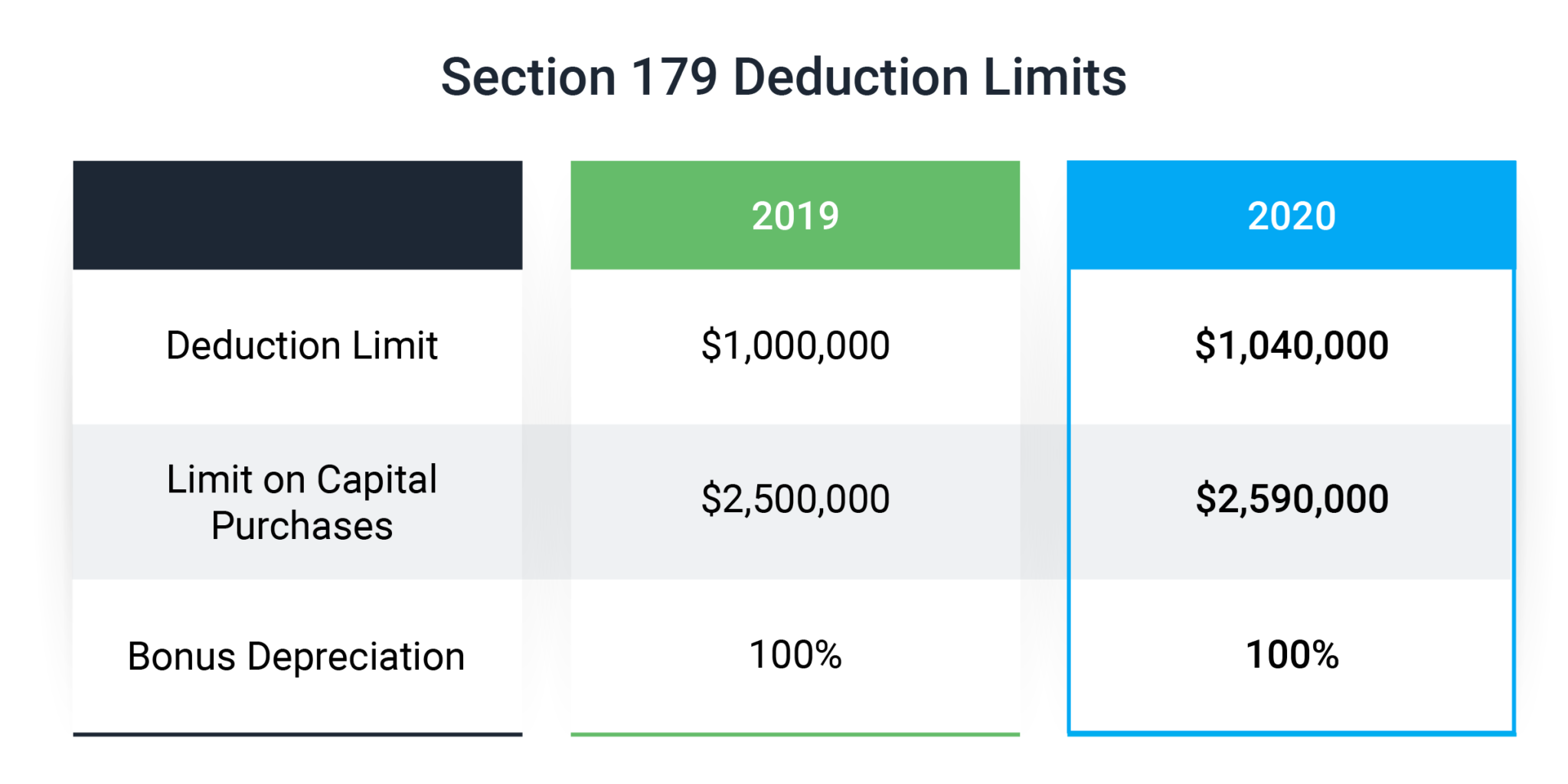

Business Expenses Deduction 2025. The asset must be first used or installed ready for use for a taxable. Understand which business expenses can be claimed as tax deductions.

NonAccountable Plan AwesomeFinTech Blog, You also need to apportion for private and business use, understand the.

Employee Business Expenses Deduction 2025 Terza, To get started, what is a deductible unreimbursed employee business expense?

Small businesses with an aggregated annual turnover of less than $50 million will be allowed an additional 20% tax deduction to support their digital operations and digitise their. What changes did the tax cuts and jobs act make to deductible business expenses?

Warped Tour 2025 Compilation. Warped tour announces its return in…

Qualified Business Deduction 2025 2025, Here's how those break out by filing status: